lake county real estate taxes covid 19

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Return to Work - Worksite Prevention Protocol.

An Overview Of The Taxation Of Residential Property Is It A Good Idea Public Sector Economics

The County does not have the authority under State law to extend or postpone the second installment property tax deadline of April.

. The other 50 percent is due by Aug. Return to Work - Worksite Prevention Protocol. Given the significant interest as.

Likewise the second installment which had been due Sept. In its June 29 report the grand jury leveled criticisms at the city that included alleging that the city was using. On March 31 2020 the County of Lake Tax Collector published a Frequently Asked Questions document.

Protecting the Public and Our Employees. Lake County Tax Collector 255 N Forbes Street Rm 215 Lakeport CA 95453. 412020 42831 PM.

Protecting the Public and Our Employees. Home Departments Treasurer Property Tax Due Dates. To deliver my property tax payment and County Buildings are closed how.

County of Lake Tax Collector March 31 2020 1. 8 now will not be considered late until Nov. Division 2 County Div Room 2 COVID-19 Information 2293 N.

Lake County Ohio. Physical Address 18 N County Street Waukegan IL 60085. The Clearlake City Council has approved a lengthy and detailed response to the Lake County Civil Grand Jurys report on issues the city has raised with the Treasurer-Tax Collectors Office and its handling of tax-defaulted property sales.

Can the Tax Collector extend the April 10 2020 deadline. Coronavirus COVID-19 Impact to Property Taxes. Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022.

Can the Tax Collector extend the April 10 2020 deadline. The Board of Supervisors is aware many residents have questions regarding how Property Tax payments will proceed in light of the COVID-19 crisis. The first installment of property tax bills is due on June 8.

Microsoft Word - COVID-19 Impact to Property Taxes FAQs 03-20-2020 Author. The Lake County Community Economic Development Department will hold a public hearing on the preparation of its one-year 2022 Annual Action Plan at. Apply for Property Tax Deductions.

Ad Find Out the Market Value of Any Property and Past Sale Prices. Main Street Crown Point IN 46307 219 755-3000. Under the new plan only half of the first payment will be due at the time.

And health effects of COVID-19 on Hoosiers with disabilities and to increase community and workplace inclusion for this population. Lake County Tax Collector 255 N Forbes Street Rm 215 Lakeport CA 95453. Skip to Sidebar Nav.

All Lake County taxpayers are set to receive notice from the. 105 Main Street Painesville OH 44077 1-800-899-5253.

The Covid 19 Pandemic And Structural Transformation In Africa Evidence For Action

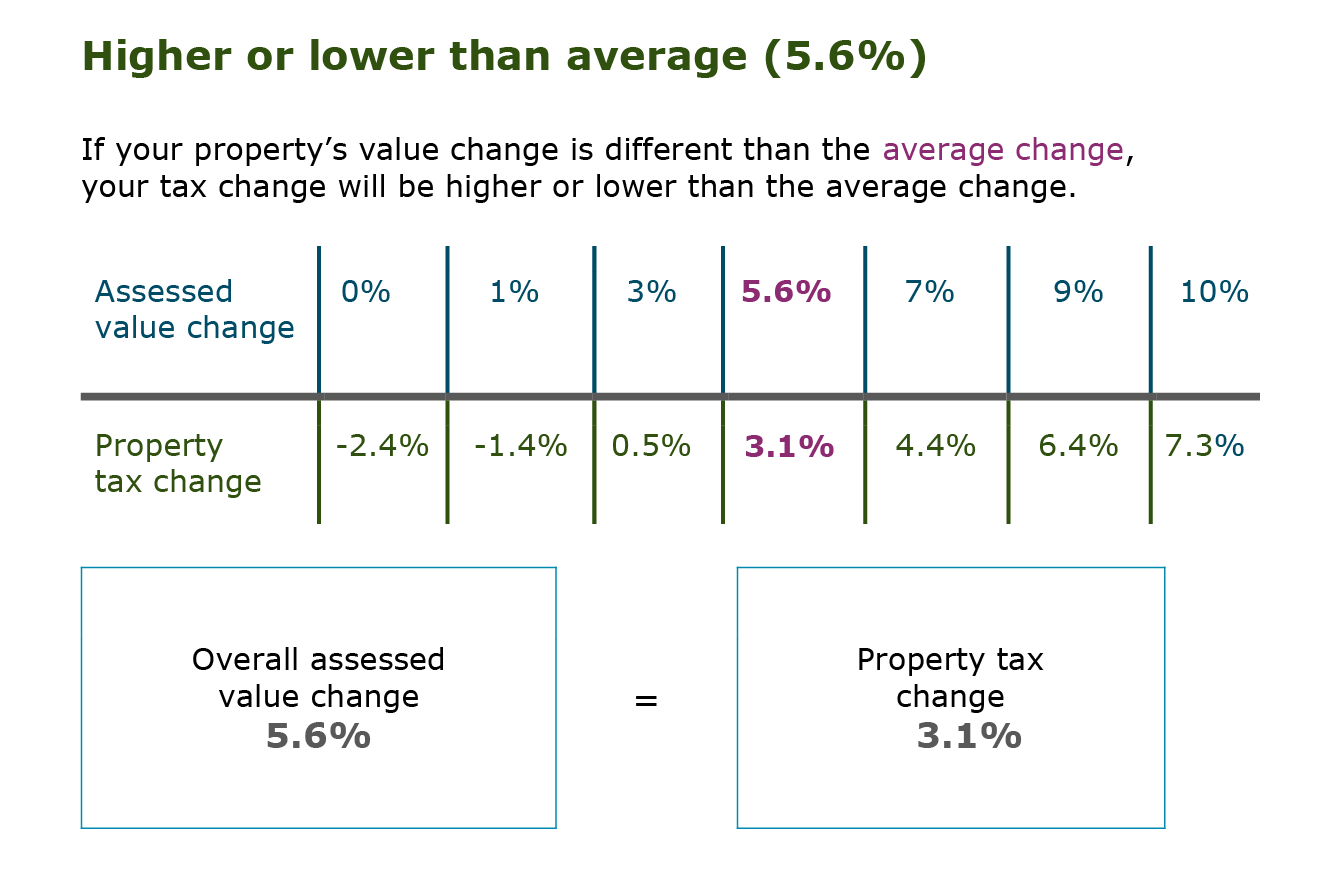

Property Taxes Strathcona County

Greece Deadline For Tax Payments Extended Kpmg United States

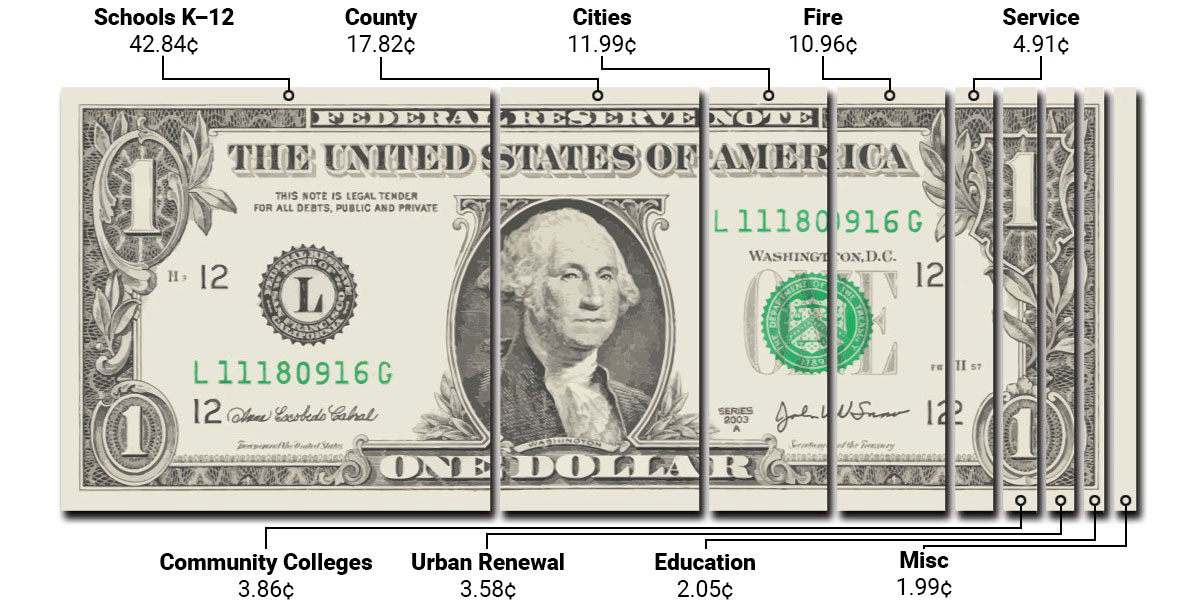

Where Your Tax Dollars Go Clackamas County

Considerations For Non U S Investors In U S Real Estate

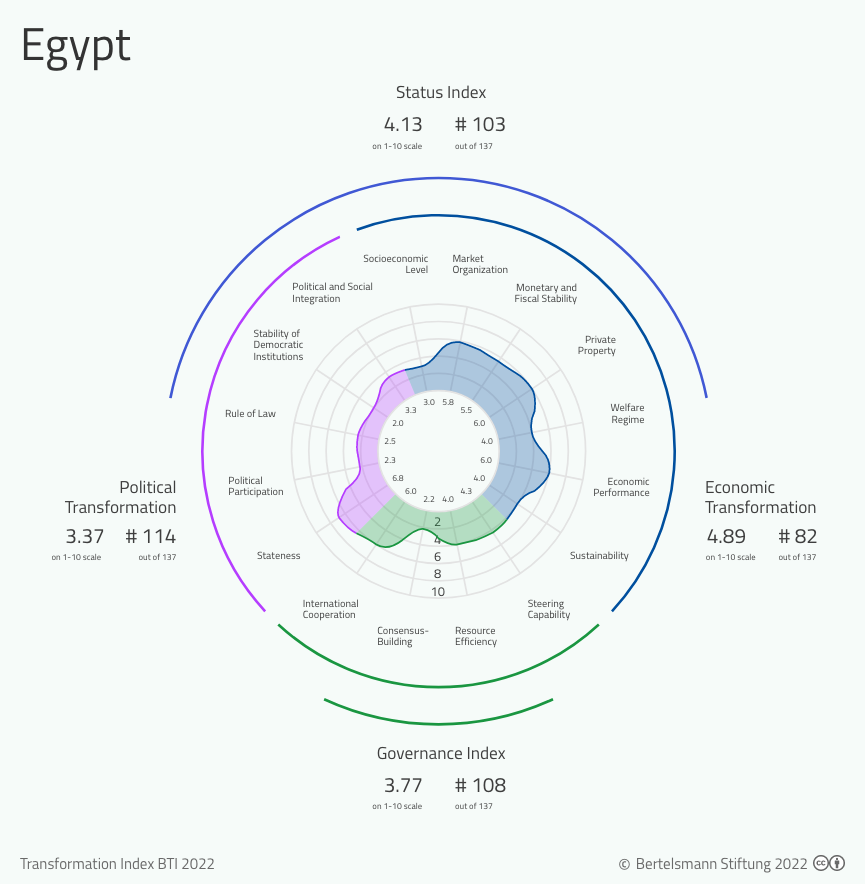

Bti 2022 Egypt Country Report Bti 2022